ADS

Halifax Clarity Credit Card

-

Annual Fee

No annual fee for spending abroad.

-

Rewards rate

This card is often used for travel and spending abroad, so it may not offer traditional rewards.

-

Intro offer

There may not be a specific intro offer mentioned.

ADS

-

Recommended Credit Score

Good to excellent credit score.

The Halifax Clarity credit card

- Charges the same interest rate on everything you buy. This helps you keep track of your spending and borrowing costs.

- You won’t be charged any foreign transaction fees.

- Any money spent abroad will be set by the Mastercard exchange rate on that day.

- Pros:

- No foreign transaction fees.

- No annual fee.

- Suitable for travel.

- Cons:

- No introductory offers on balance transfers or purchases.

- No rewards or cashback.

When you have a credit card, what feature captures your attention the most? For some people, it’s the benefits or perhaps the travel services. However, for me, what stands out is when a credit card has an excellent management system. There’s nothing better than applying for a credit card, receiving it, and then discovering that using it is incredibly straightforward.

ADS

If you happen to know a credit card that not only offers seamless management but also comes with a plethora of benefits, you might be describing the Halifax Clarity Credit Card. Yes, I’m mentioning this credit card again, but believe me, it is a commendable credit card. I wouldn’t be emphasizing it so much if it didn’t live up to its merits, and of course, you wouldn’t be reading about it if it didn’t pique your interest. Let’s delve into more details about this credit card below.

What are the requirements to request the Halifax Clarity Credit Card?

Have you ever wondered about the requirements needed to apply for this credit card? If you examine other credit cards, you’ll notice that each one has its unique set of prerequisites, documents, and other necessary details. So, is it the same for this one? Perhaps not. That’s precisely why we’re providing you with an informative list of all those requirements.

- Must be 18 or older.

- Must have a bank account.

- You must be a UK permanent resident.

- Needs a good credit history.

What are the necessary documents to request the Halifax Clarity Credit Card?

Unfortunately, like any other financial product, this one requires you to submit some essential documents to verify your identity. If proving identity were an easy task, obtaining any financial service would be a breeze, and that’s not our goal. We aim to make the process thorough to deter fraudulent activities. Let’s take a look at the required documents below.

- Proof of income.

- Identity documentation.

- Proof of residence.

Who should apply for the Halifax Clarity Credit Card?

If you’re curious about the requirements for this credit card, rest assured that it comes with a plethora of positive qualities and just a few minor drawbacks. These drawbacks don’t make the card overall bad or too complex to use. Instead, they signify that a broader range of individuals can apply for it, opening up the opportunity for more people to enjoy the benefits of this card. Let’s explore some profiles that might find this card particularly appealing.

Halifax clients

Certainly, one of the primary profiles that would benefit from the Halifax Clarity Credit Card is the clients of the company itself. Where else would the most beneficial features be if not for their own clients? It’s intriguing to think about because it implies that you’ll not only receive more benefits but also be able to enjoy them more fully, given your familiarity with the company.

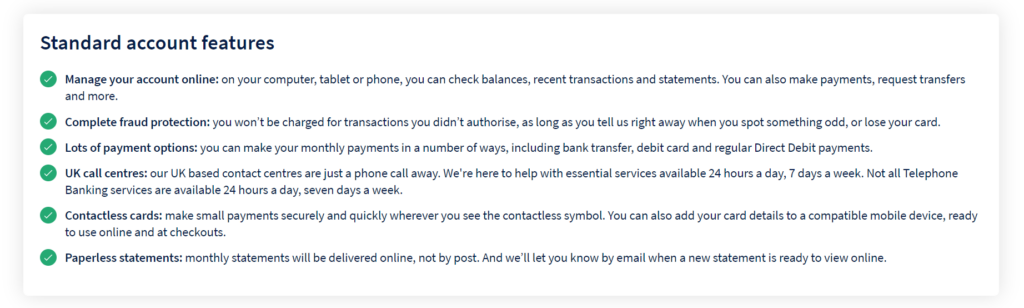

If you value security

When you make a purchase and receive a confirmation message to verify your identity, this credit card provides that security feature for free with every transaction. You’ll receive a message for each purchase to ensure it is indeed you making the transaction, preventing potential fraud. Additionally, the company will proactively block your account in case of suspicious activity, enhancing the overall security of your transactions.

For those who like to organize everything

If you’re someone who enjoys keeping everything organized, including your finances, then the Halifax Clarity Credit Card might be the perfect fit for you. This card is designed to simplify the management of your account and the associated credit card. Whether on your tablet, computer, or cellphone, you can easily handle payments, transfers, and other transactions, making financial organization a breeze.

If you appreciate different payment options

Another profile that can benefit significantly from this credit card is individuals who enjoy making payments in various ways. With the Halifax Clarity Credit Card, you have the flexibility to choose your preferred payment method for each transaction. This versatility in payment options adds an extra layer of convenience, making the credit card a great choice for those who value diverse payment methods.

One piece of advice for those wishing to apply for the Halifax Clarity Credit Card:

If you’re eager to learn everything about this credit card and considering applying for it, you should be well-informed before starting the application process. Whether the Halifax Clarity Credit Card is the perfect fit for you or just a card that meets your needs, it’s crucial to have a clear understanding of what it entails, including its benefits and downsides—details that many people may overlook.

To make the application process faster and easier, take the time to research and familiarize yourself with the Halifax Clarity Credit Card. Knowing the pros and cons of a card will not only speed up the application process but also ensure that you make an informed decision that aligns with your financial preferences and needs. So, before you apply, invest a bit of time in exploring the specifics of the Halifax Clarity Credit Card.

Is this card really worth it? Let’s compare the pros and cons

As you can see, this section aims to help you determine if it is genuinely worth applying for this credit card. If you’ve reached this point in the article, I hope you’ve already formed a decision, considering you’ve read through two articles. Regardless, let’s evaluate whether applying for this credit card is a worthwhile endeavor.

In either case, it’s evident that this credit card brings forth numerous benefits. While it may not offer the extravagant perks of some high-end cards, it stands out as an excellent option. With features like contactless payment, enhanced organization capabilities, fraud protection, and a variety of payment methods, the Halifax Clarity Credit Card offers valuable qualities. From my perspective, it is indeed worth considering.

Apply now for the Halifax Clarity Credit Card

The application process is not going anywhere, but you can expedite it more than usual. If you’re eager to apply for this credit card, click on the link below to proceed with the application.