ADS

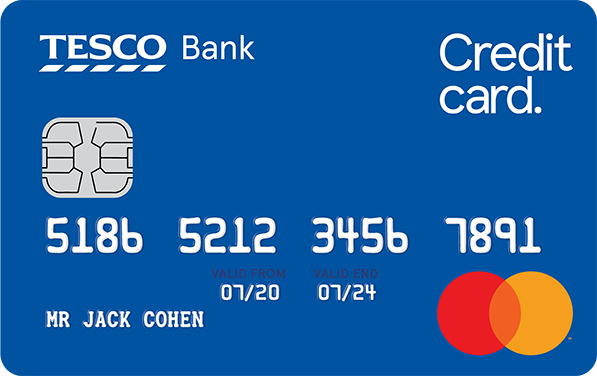

Tesco Bank Foundation

-

Annual Fee

No annual fee

-

Rewards rate

This card typically does not offer cashback or rewards.

-

Intro offer

There may not be a specific intro offer mentioned.

ADS

-

Recommended Credit Score

Good to excellent credit score.

- Starting credit limits between £250 – £1,500 and monthly repayments from £25

You may be considered for regular credit limit increases if you make your minimum payments on time, stay within your credit limit and similarly manage any other credit cards or loans you have with us. - Track your credit score Get access to Tesco Bank CreditView, provided by TransUnion, for 3 years from account opening and track your credit score with monthly updates.

- Track your credit score

Get access to Tesco Bank CreditView, provided by TransUnion, for 3 years from account opening and track your credit score with monthly updates.

- Pros:

- Designed to help build your credit rating.

- Collect Tesco Clubcard points.

- No annual fee.

- Cons:

- High interest rates.

- Limited additional benefits.

Are you eager to delve deeper into the features of a credit card that not only has the potential to elevate your credit score but also offers tools to help you monitor it actively? This is where the NatWest Balance Transfer Credit Card steps in. Crafted with a specific objective, this card is designed to be more than just a financial tool.

ADS

Its primary purpose is to empower you to enhance your credit score, providing you with the financial flexibility needed to fulfill your desires. Take a closer look at the unique benefits and features it offers, and embark on a journey towards improved financial well-being with the NatWest Balance Transfer Credit Card.

What are the requirements to apply for the Tesco Bank Foundation Credit Card?

Now that you’ve gained some insights into the benefits of this credit card from the introduction, I’m sure you’re more eager to apply for it. To make the application process easier for you, here are the straightforward requirements:

- You must be 18 years old or older.

- You have to reside in the UK.

These are the basic criteria you need to meet to be eligible to apply for the Tesco Bank Foundation Credit Card.

What are the necessary documents to apply for the Tesco Bank Foundation Credit Card?

If you’re considering applying for this credit card but unsure where to begin, a crucial step is understanding the required documents for the application process. Let’s delve into the essential documents you’ll need:

- Identification: A valid form of identification is necessary for the application process. This could include a driver’s license, passport, or other government-issued ID.

- Proof of Residence: To establish your residency, you’ll need to provide proof of residence. This might include utility bills, rental agreements, or other documents that verify your address.

Ensuring you have these documents ready will streamline the application process for the Tesco Bank Foundation Credit Card.

Who should apply for the Tesco Bank Foundation Credit Card?

As we approach the end of this article, and if you’re ready to grasp all the essential details about the Tesco Bank Foundation Credit Card, you might be at the point where you’re considering applying. Before you do, let’s explore if you fall into any of these profiles. It’s important to note that these are not strict requirements, but rather profiles that may derive greater benefits from the card.

Tesco Bank Clients:

If you are a client of this bank, I’m confident that your benefits will significantly enhance. While the benefits won’t technically double, being an existing client grants you a better understanding of their offerings. If you have any doubts, you can easily approach them for assistance, making the application process more straightforward.

People with Bad or Nonexistent Credit Scores:

If you have a poor or nonexistent credit score, which can indeed happen, this credit card might be a suitable option. Building a credit score is not a universal achievement, and if you are just starting to establish yours, this credit card can play a crucial role in helping you build or improve it.

If you don’t mind having fewer benefits:

While a credit card with fewer benefits may raise concerns in many cases, this is a unique credit card. Given its primary focus on improving your credit score, it may not offer an extensive list of benefits. This doesn’t necessarily make it a bad card; it simply means it prioritizes other aspects.

If you like to track your credit score:

This credit card is specifically designed for individuals aiming to improve their credit score. Therefore, one of its key features is the ability to track your credit score. If you value staying informed and receiving updates on your credit status, applying for this card might be the right choice for you.

One piece of advice for those wishing to apply for the Tesco Bank Foundation Credit Card:

The application process is surprisingly short—contrary to common belief. Applying for a credit card typically takes around 5 to a maximum of 10 minutes, and no more than that. It’s exceptionally fast, but not many people are aware of this, so consider this more of a heads-up than advice. It doesn’t take as long as people perceive.

Now, for a genuine piece of advice that might just change your perspective and positively impact your life. My aim is to provide you with valuable insights that you may not have considered before, something that will leave you amazed. I believe this advice is quite robust, and I hope you’ll agree.

The advice I want to share is: don’t overly stress about having a high credit score. While a good credit score is undeniably important, considering that this card is specifically designed for individuals with poor or no credit, you don’t need to excessively fixate on your score. Instead, focus on learning more about the credit card itself and gather all the relevant information it entails.

Is this card really worth it? Let’s compare the pros and cons.

Are you certain you’re ready to apply for this credit card? While I recognize its value and believe I could benefit from it, this article is dedicated to helping you in your search. I want to conclude this article knowing that I’ve provided you with at least a bit of assistance.

In my opinion, this card is genuinely worth considering, and it might be valuable for you as well. Its worth is evident when we weigh the pros and cons. True, it doesn’t boast a high credit limit or extravagant benefits. Instead, it falls more in the category of a basic card. However, its value lies in features such as credit score tracking, point collection for prizes, and, most importantly, its primary focus on helping you build a credit score.

Apply now for the Tesco Bank Foundation Credit Card!

Did you know that the application for the Tesco Bank Foundation Credit Card is conveniently just a click away? All you need to do is simply click on the link provided below, and I’m confident that with that action, you will be seamlessly redirected to the credit card application page. Take this easy step to begin your journey with the Tesco Bank Foundation Credit Card.