ADS

Amazon Business American Express Card

Do you have any idea how good credit cards are made? Well, there are several factors that contribute to the creation of a good credit card. The first and foremost consideration is understanding what the public desires in a credit card. If you can identify the features and benefits that the public values, you are on the right track to creating a successful card. Many companies recognize this and start producing credit cards tailored to meet these preferences.

This principle is exemplified in the case of Amazon Business. Amazon, being an immensely popular online store, has a broad customer base. Almost everyone is familiar with Amazon, and many have made purchases on the platform. Consequently, Amazon has decided to capitalize on this by introducing a credit card in collaboration with American Express.

The Amazon Business American Express Card is an exceptional credit card that offers numerous advantages for your daily life and when shopping on the platform. By obtaining this card, you can enjoy enhanced benefits and qualities that set it apart from cards offered by other stores. If you are interested in learning more about the features and perks of this credit card, continue reading.

ADS

We recommend the Amazon Business American Express Card

First and foremost, when individuals apply for credit cards, the primary goal is to simplify their lives and maximize the benefits associated with the specific store or company. In the case of the Amazon Business American Express Card, this recommendation is driven by the desire to enhance the overall shopping and financial experience for the cardholder.

The Amazon website stands out as one of the most renowned and widely used online stores globally. Given its widespread popularity, it’s highly likely that many people have made purchases on Amazon at some point. With such a strong presence and user base, it becomes a natural progression for the store to introduce a credit card. Recommending this credit card is a reflection of the widespread trust and recognition that Amazon enjoys.

ADS

Moreover, the Amazon Business American Express Card offers a multitude of benefits, not only within the Amazon store but also outside of it. This versatility makes it a robust credit card option, suitable for individuals who may not be frequent Amazon shoppers. The comprehensive range of benefits, both within and beyond the Amazon ecosystem, makes this credit card an attractive choice for anyone looking to apply for a credit card with substantial advantages.

In summary, we highly recommend the Amazon Business American Express Card for its convenience, widespread recognition, and the diverse array of benefits it provides, making it an excellent choice for individuals seeking a credit card that goes beyond the ordinary.

Our opinion about the card

I must acknowledge that it stands out as an exceptional credit card. Even when considering other credit card options, the decision-making process typically involves two key considerations: whether to apply for the card and, if approved, how to make the most of its features. Fortunately, the Amazon Business American Express Card streamlines this thought process.

The appeal of this credit card lies in its dual benefits. Firstly, it serves as an excellent American Express credit card, offering substantial advantages and perks. Secondly, it caters specifically to those seeking a credit card affiliated with Amazon, a renowned online platform. This dual functionality eliminates the need for extensive contemplation, as the card seamlessly aligns with two common motivations for applying for credit cards.

In essence, there are essentially two compelling reasons to consider this credit card: seeking a high-quality American Express card with numerous benefits and desiring a credit card associated with Amazon for additional perks. Given these factors, I confidently assert that this credit card is remarkable, and I wholeheartedly recommend applying for it. It is evident that my perspective on this credit card is exceptionally positive.

Learn about the pros that the Amazon Business American Express Card offers:

Can you envision all the advantages and disadvantages associated with this credit card? I certainly can, having thoroughly researched it. I’m prepared to provide you with comprehensive insights into the benefits and advantages offered by the remarkable Amazon Business American Express Card.

- Cashback of 1.5% on Amazon purchases

- Cashback of 0.5% on other non-Amazon purchases

- 60 days deferred payment

Now, let’s delve into the cons of the Amazon Business American Express Card

While this credit card boasts numerous benefits, it’s essential to be aware of its drawbacks to make informed decisions about its usage. If you are interested in gaining a comprehensive understanding, continue reading for insights into the potential drawbacks of the Amazon Business American Express Card.

- Focus on Amazon benefits: The card is primarily oriented toward providing benefits for Amazon purchases, potentially offering fewer advantages for transactions outside the Amazon platform.

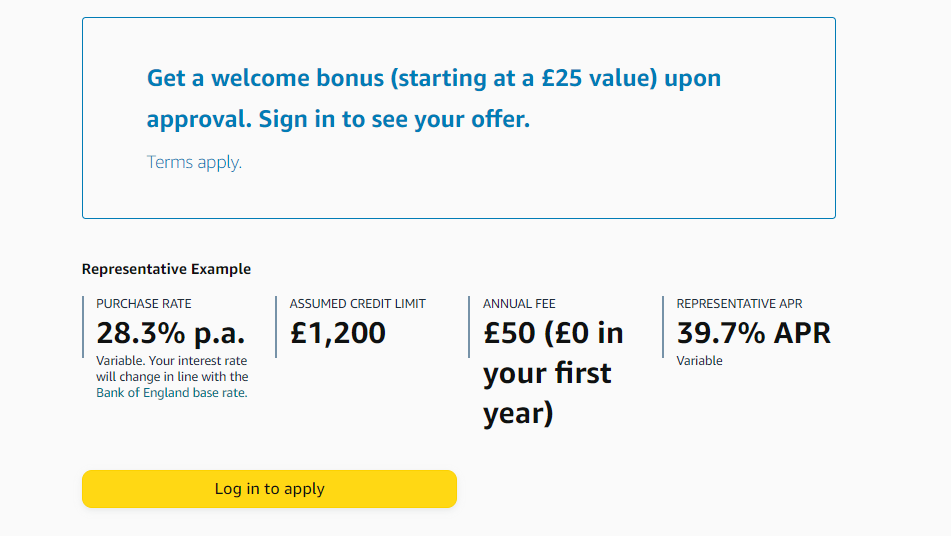

- Annual fee of $50: One notable drawback is the presence of an annual fee amounting to $50.

By being aware of both the advantages and disadvantages, you can make informed decisions about whether the Amazon Business American Express Card aligns with your financial needs and preferences.

How is the credit analysis conducted for the Amazon Business American Express Card?

Credit analysis is a routine procedure integral to the application process for credit cards. When you apply for a credit card, the company needs to assess your creditworthiness, ensuring a mutually beneficial arrangement. This evaluation is precisely what credit analysis entails.

The company seeks to determine if you are financially responsible, capable of managing credit without accumulating excessive debts. The primary tool used for this assessment is your credit score. Your credit score is derived from a comprehensive examination of your financial situation, encompassing factors such as existing debts, payment history, and any outstanding obligations.

Once the credit analysis is complete, you will be assigned a credit score, which plays a crucial role in determining whether you qualify for the Amazon Business American Express Card. It is important to note that the company can access your credit history based on the personal information provided in your application form.

In summary, the credit analysis process is designed to gauge your financial responsibility and determine your eligibility for the Amazon Business American Express Card, making it an integral step in the credit card application process.

Does this card have a pre-approved limit?

No, this credit card does not come with a pre-approved limit. Consequently, you won’t have a predetermined amount for your credit card, which may be viewed as a drawback by some individuals. However, you can estimate the potential limit based on your credit score. A higher credit score generally indicates a likelihood of a higher credit limit, while a lower credit score may result in a more modest limit.

If you’re considering applying for this credit card, it’s essential to be aware of this characteristic. Knowing your credit score can give you a rough idea of the potential credit limit you might receive.

Interested in applying for the card? Learn more about the application process below!

Undoubtedly, you may be eager to apply for this credit card. Before you do, let’s delve into more details about its features and benefits. Explore the information provided below to make an informed decision about applying for the card.